The financial services industry is an increasingly crowded space. Traditional banks, credit unions and financial institutions are competing against new fintech entrants who are disrupting the industry and siphoning away customers. Now more than ever, a strong brand and clear message are key for cutting through the noise to reach and retain customers. When building or refreshing your brand, it’s imperative to carve out a strategic position that sets your financial institution’s products and services apart and can earn customers’ trust.

The Objective of Financial Brand Positioning

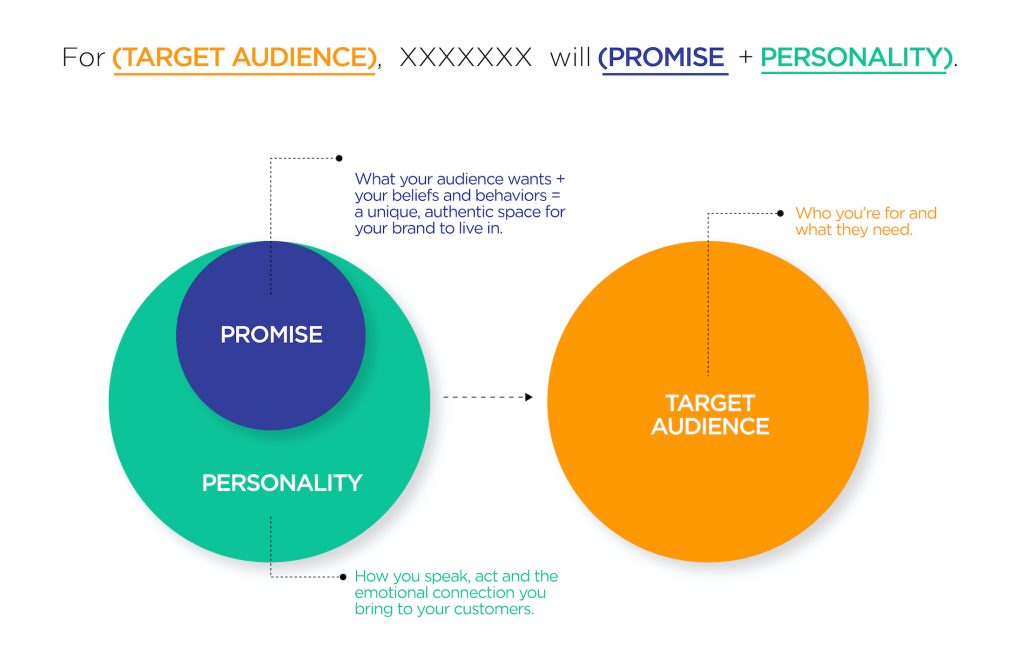

At its core, brand positioning should center a business as its own unique entity to separate it from other competitors or companies in the same category. In the financial industry, multiple institutions will be offering the same features and services. When focusing on your company’s brand in the financial sector, you must think about how you will set your business apart from the others.

Ask questions such as:

- What can we do better than anyone else?

- How can we take a different approach to the “norm?”

What Should a Financial Institution’s Messaging Accomplish?

A financial institution’s messaging should use confident, clear and sincere language that keeps information digestible and approachable. Once your company has distinguished itself as one-of-a-kind with a language strategy in place, it should seek to answer three questions as simply as possible in its messaging:

- Brand: Who are we?

- Offering: What do we do?

- Approach: How do we do it?

Establishing a Brand for Your Financial Institution

When developing a brand in the financial sector, it is extremely important to be reputable. Handling people’s money requires a lot of trust from the customer. To deepen customer loyalty and affirm their decision to use your services, you should offer full transparency. Lastly, with the surge in fintech and online banking, companies shouldn’t abandon the real, human aspect of banking services and the needs, wants and concerns that accompany it.

- Reliable – At the forefront of a financial brand, to be successful you must prove yourself reliable. The most important factor of gaining new customers and retaining loyal customers is dependent on how well your customers perceive you to deliver on promises. Money can be a sensitive – or even stressful – subject for some, so customer satisfaction is highly based on this trust. Your brand should offer customers a sense of security.

- Transparent – Another component that weighs heavily in establishing trust is transparency. Customers like to have a sense of control, especially when it comes to their money. Your brand should present itself in a way that customers feel they know all the “ins” and “outs.” Being straightforward creates a better floor for understanding and communication between business and customer.

- Humanized – Despite constant technological innovation that makes financial services easier and faster than ever before, at the end of the day your brand should still signify that you are a company full of people, serving people. Even the largest and most progressive of companies should prioritize sincere human connections. It’s important that financial institutions remember that no degree of technology could ever exactly fulfill the satisfaction of outstanding customer service.

Drafting Your Financial Messaging

Financial institutions should aim to create messaging with relevance. In the height of industry competition, prioritizing customer engagement will simultaneously allow these businesses to create an individualized experience. A potential customer’s connection with your brand and messaging will be what sets your business apart from others appealing to the same target audience. To achieve this, financial businesses should make use of multi-channel messaging to reach their target in their preferred method of communication and provide information applicable to customers’ lives. When marketing financial services, companies should use messaging that is:

- Confident – Delivery of messages in a confident tone assures customers that the company is an expert on the subject and helps gain the target’s trust. Those in the financial industry should reach their audience with messaging that is direct and invites a call to action. This tone creates the perfect opportunity for the company to first present itself as an industry professional, and then welcome customer engagement at the click of a button.

- Clear – It’s no secret that financial lingo can be daunting. Financial services should aim to keep messaging as simple and easy to understand as possible. To avoid information overload, explain complex topics and present your business as a resource. Loyal customers can be obtained from the first transaction, so it is imperative that messaging demonstrates a willingness to help the target get started and present a lifetime value to them.

- Sincere – People are tied to their money more than almost anything else, so it’s extremely important that banks and other financial institutions approach them sincerely, proving that the business has their best interests in mind. This also plays into the aspect of “humanizing” the financial sector and appealing to customers with an empathetic connection. What are consumers going to buy into: a generic automated quote or a message that actually holds a meaning to them?

- Individualized – Finances will never be a one-size-fits all, and your messaging shouldn’t be either. Acknowledge the varying needs of your target and display your business’ array of financial services with an individualized approach to messaging. Companies should use the information they already know and the research they perform about their target to intrigue potential customers with details and services tailored to them. One excellent method to distribute messages that meet this criterion is through multiple channels, otherwise known as “multi-channel marketing.”

- Customer-focused – Similarly, messaging and marketing strategies should be completely focused on the customer to ensure interests are aligned. At the center of customer-engagement marketing is the goal to “attract not intrude.” By drafting messaging that meets the target’s needs, wants and demands, those in the financial sector will be able to pique interest in potential customers and potentially begin to gain traction. Messaging should display a value of customer feedback and communicate the company’s desire to help customers achieve their goals by taking some of the stress out of financial situations.

In all, financial branding and messaging can play a significant role in attracting new customers or clients and establishing one company apart from others in the industry. These principles and strategies should be broad enough to remain applicable in a variety of campaigns and hold relevance in the long term. By placing the customer at the center of the strategy and proving themselves trustworthy, businesses in the financial sector can create a more individualized, engaging approach to finance that gives them a competitive edge – all through branding and messaging.