The shift to digital banking continues to pick up steam as the financial technology industry (Fintech) provides convenience and features that give users more control over their accounts. This movement has influenced the development of financial institutions and how they choose to market and deliver their services. From the emergence of mobile banking to redesigned websites and personalized solutions, financial institutions can enhance their business by aligning their services with the needs of modern consumers. Rivers Agency recommends these best practices for the Fintech industry to modify current strategies and achieve goals for a variety of target audiences.

Website Redesign

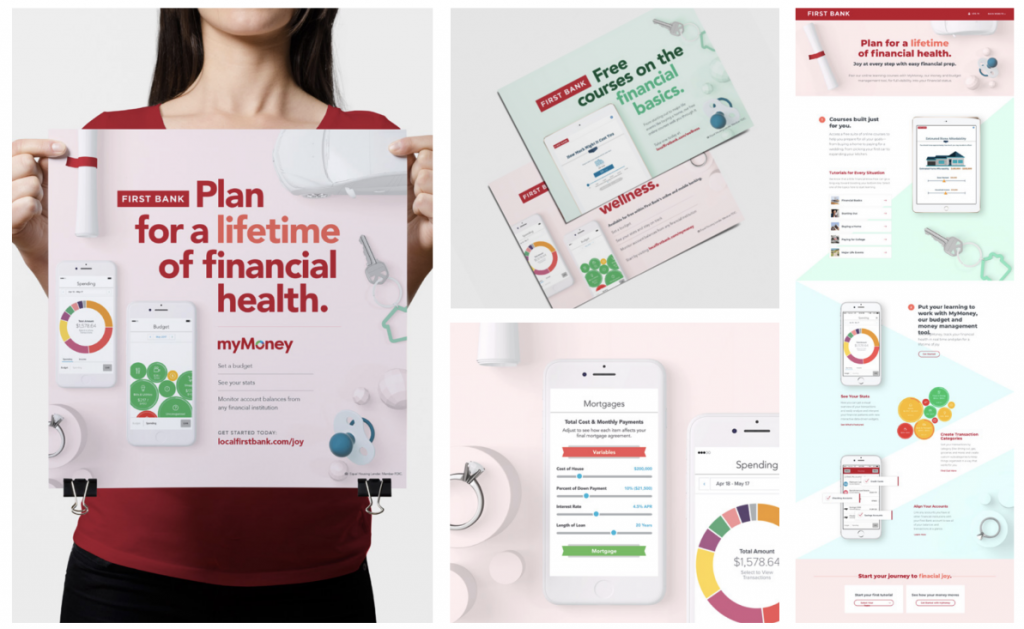

The key to building a successful website is entirely based around the user experience. As a financial institution, you will want to make your website extremely accessible and user-friendly for people of all ages. Navigation should be clear and direct. In addition to having distinctly marked web pages or sections, try including a hero “call to action” on your homepage that helps users “Get Started Today,” “Download the App,” or “Open an Account Now.” This simple feature added to an institution’s home or landing page is an effective practice that will increase convenience for users and allow the institution to efficiently customize this approach to their goals.

User experience should also be considered in terms of personalization. To gain more interaction, accounts, or any type of consumer awareness, you will want to connect your audience and services in a meaningful way. One way to do this is with carefully curated features that are “Recommended for You” or relevant “featured” articles and videos. To strengthen the relationship between your target or consumers and your institution, include easy-to-use chat features on your website with quick responses from live representatives who are there to answer questions and help shape this individualized experience.

Mobile Banking

Nowadays, many consumers rely on mobile banking and its accessibility. Having your finances always available at your fingertips has become a norm in today’s technology age, yet some may still be wary in regards to security. To combat this issue while improving mobile banking platforms, financial institutions should strive to increase the ease of user experience while strengthening security measures. Incorporating two-step verification, automatic log-outs after inactivity, and a variety of security settings within the application will reinforce mobile banking’s reputation while giving users peace of mind that their money is safe.

Many institutions have expanded to mobile banking services, which makes user experience especially important in this area. You want your application to be the easiest to use and understand, and be the fastest at it. Allow users to personalize short-cuts within the application, make help services easier with an in-app chat feature, or include personalized tools and service for easy use.

Consumer Outreach

Since consumers are interested in becoming invested in their financial lives, education is key. If financial services are looking to better market themselves, become more involved in the community, and build a strong reputation for themselves, they should engage in customer outreach. This could take the form of consultations, targeted emails, seminars, or educational programs that seek to inform a variety of target audiences. By assisting consumers in jumpstarting their financial education, your institution will be the name that pops into their heads when they begin their financial journey.

Data Analysis

Above all, the method that underlies most of these best practices is highly specified data analysis. You will need your consumers’ data to actively target their needs and create the ideal, personalized banking experience. Better yet, you will want to anticipate their needs. Assess where your customers are in life; demographics such as age, gender identity, education, geographic location and occupation, or lifestyle choices such as purchase habits, investments, and travel will be large indicators. This is the perfect opportunity to customize rewards programs, accounts, educational courses, and testimonials to what best fits your consumers to drive your institution’s desired outcomes. By routinely synthesizing this data, financial institutions can save time and money on research and marketing efforts and dive straight into improving user experience.

Need help? We might be just the right fit. If you’re struggling to handle a marketing, public relations, graphic or any other creative project on your own, we’re here to help. To learn more about our services, feel free to contact us. We can discuss your needs and dreams in depth and determine the next steps you need to take to accomplish your goals.